2017 east Florida street Proposal

provided by the whipple group

Due to the fact that there are no recent comps near the size of the subject property, even going back over two years, it makes more sense to take smaller properties to evaluate and determine a current market value for the home.

Going back one year in past sales, using the sales comparison approach, I found these comps to be the most relevant for analysis.

Of course, the biggest difference between these homes and the subject property is square footage. We cannot rely on just using the price per square foot as a valuation analysis because the relationship between price and square footage is not linear; as the size of a property increases, the price per square foot typically decreases. This diminishing rate of growth means that applying the same price per square foot of a smaller property to a larger property would overestimate its value.

Instead, I analyzed the correlation coefficient between square footage and sales price. Based on this sample of comparable sales, that ratio is .47, representing a moderate positive relationship: as the square footage of the home increases, so does the sales price. In this case, with these comps, the square footage has a positive 22% correlation with price. While there are other factors, such as condition and location, considering that some of the comps have superior condition (such as fully remodeled kitchens) and the locations of the comps run along the spectrum of more desirable areas (South of 3rd and Broadway) and less desirable (north of 4th) I think it’s reasonable to use just the square footage for now for valuation.

Taking only that variable into consideration, and based off of these comparable sales, just by square footage alone, that would put your current market value for your home today at $1,139,435 which isn’t too far off of the Zillow estimate at $1.2 million. I see that Redfin estimates it at $1.4 million, but in my experience, Redfin tends to skew much higher than the market value based on many estimates.

Because we are not listing your home today, and the market has recently slowed down with increasing days on the market and increasing price reductions, I don’t think it’s prudent to push the value much higher than the estimation of value we landed at with the correlation coefficient estimate. Since we are using it as a baseline to forecast future value based on past market trends, I feel more confident in running this analysis lean and landing on conservative numbers rather than overestimating current market value today and winding up way off base for your future predictions, mainly because I know you are using this data to forecast your future retirement savings.

Now, to forecast future appreciation, I think it’s more accurate to use the average appreciation rate over the last several years, before Covid, rather than the most recent few years since the extraordinarily low interest rates during Covid caused market conditions and demand that we will likely not see again, due to the very low interest rates.

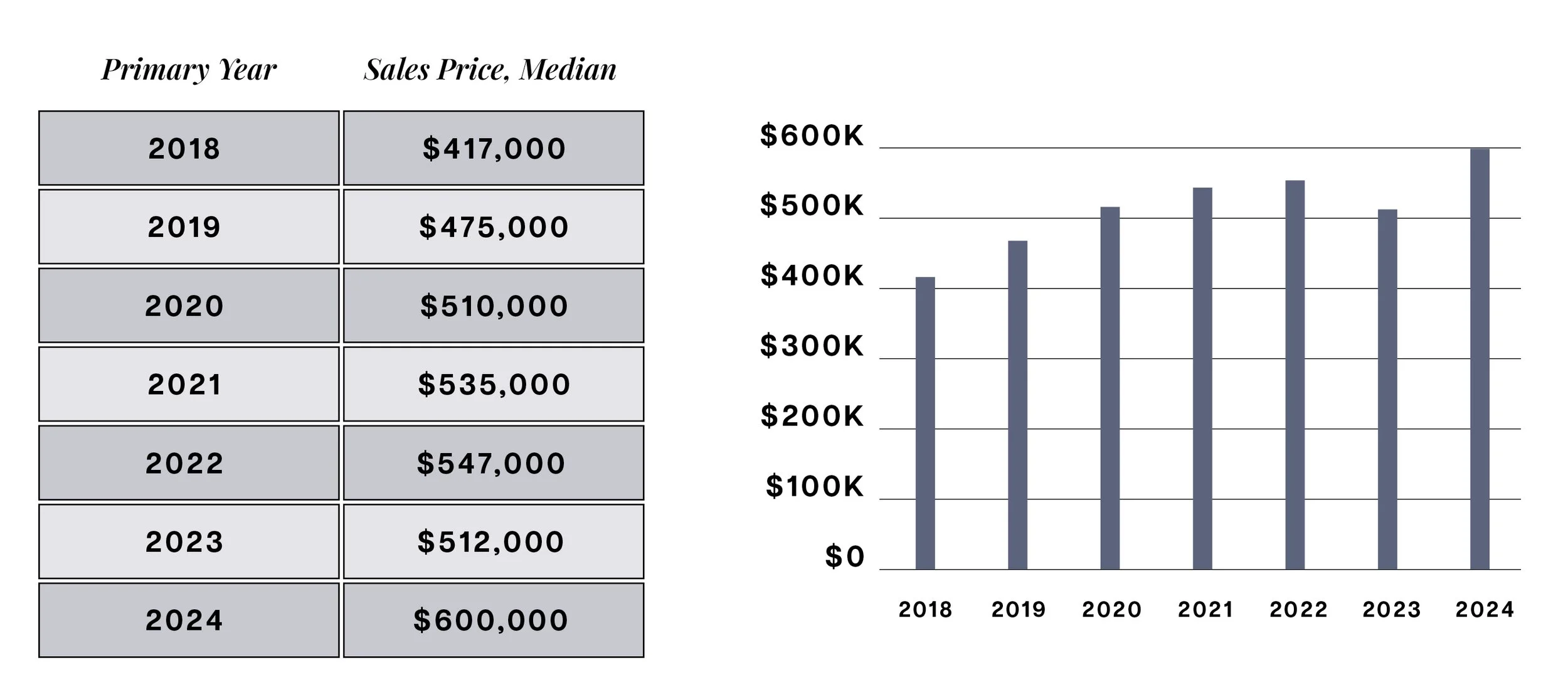

From January 2018 to January 2024, the average increase in the appreciation of sales price for single-family homes in your area averaged 3.06% as evidenced by this chart and data:

Taking that moderate rate of appreciation into account, we can extrapolate that in 2027, we can expect a value of $1,377,932, a net increase of $238,497 over the current 2024 value based on this analysis, which to me sounds reasonable.

recommended improvements

that can be made to the property to increase its value are as follows:

Remodel and reconfigure the kitchen to be more updated and a more efficient use of space

Paint the exterior a more traditional or more modern color scheme to increase curb appeal

Replace chain link fence with a wood or wood-style fence

Bring bamboo flooring into the kitchen so the flooring is uniform with the living and dining room.

Create an access point from one of the downstairs bedrooms to the side yard with french doors and a small deck.

Paint interior swiss coffee throughout