1705 Via Estudillo

value and market analysis

Prepared for Liz Findley

Overview of comparable homes

I put together a screencast above (click the play button and turn the sound on please) so that I can share with you my comp analysis of the homes that I selected to use in my comparison for value on 1705 Via Estudillo. As you’re aware, there are not many homes that share the quality of view and lot size. I mainly looked at comparable sales to have a baseline of view, location, size, and lot size. From then, I factored in the condition of the home and what I’m seeing in the market for other active properties.

Based on strictly comparable sales and taking into account the features and condition of 1705 Via Estudillo, my initial value range is between $3,000,000 and $3,500,000. As I detail in the screencast, I’d like to visit two of the active listings in person prior to settling on a number within that range. Once I’ve visited those listings, I can have more information to analyze how 1705 Via Estudillo will perform on the market given a certain price point. I will share these comparables with you in the link below so you can review them at your leisure.

market trends

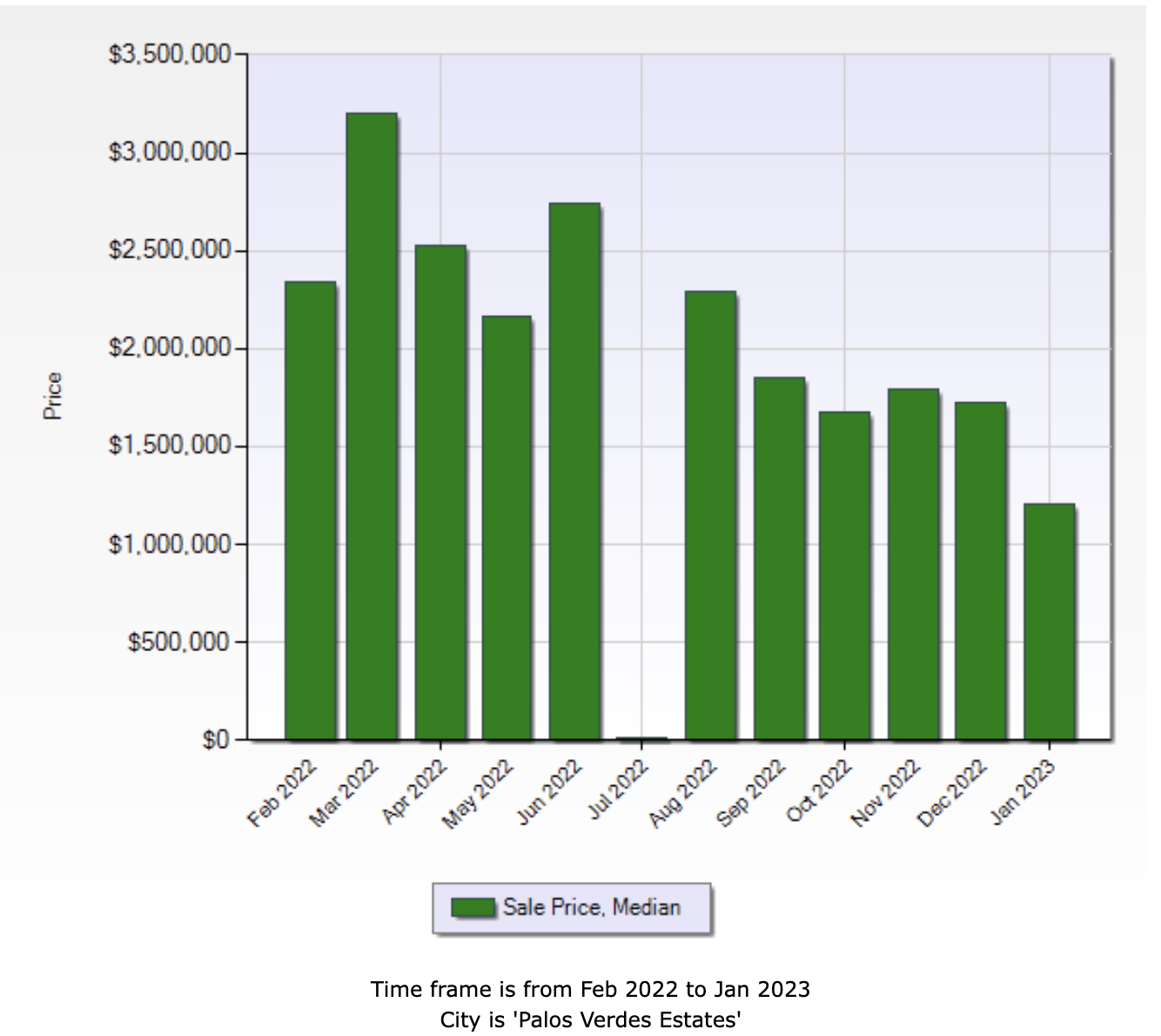

Further, I put together some information on market trends for homes that have sold over the past year in Palos Verdes Estates. I ran reports on the median sales price of all homes that have sold in the last 12 months. Then, I took the average of the median sales price from Q3 of last year and compared it to Q4 of last year. I use the median sales price for my data because an average can get skewed by an outlier either high or low.

The median sales price for Q3 (which was when the market was still very hot and prior to rates radically increasing in a relatively short period of time) was $2,071,450. In Q4 of 2022, which was the slowest period of sales due to rates increasing drastically in a short period of time, the median sales price averaged $1,727,500. This is a 16% decrease in the median sales price between Q3 and Q4 of 2023. Please refer to the chart below for the data.

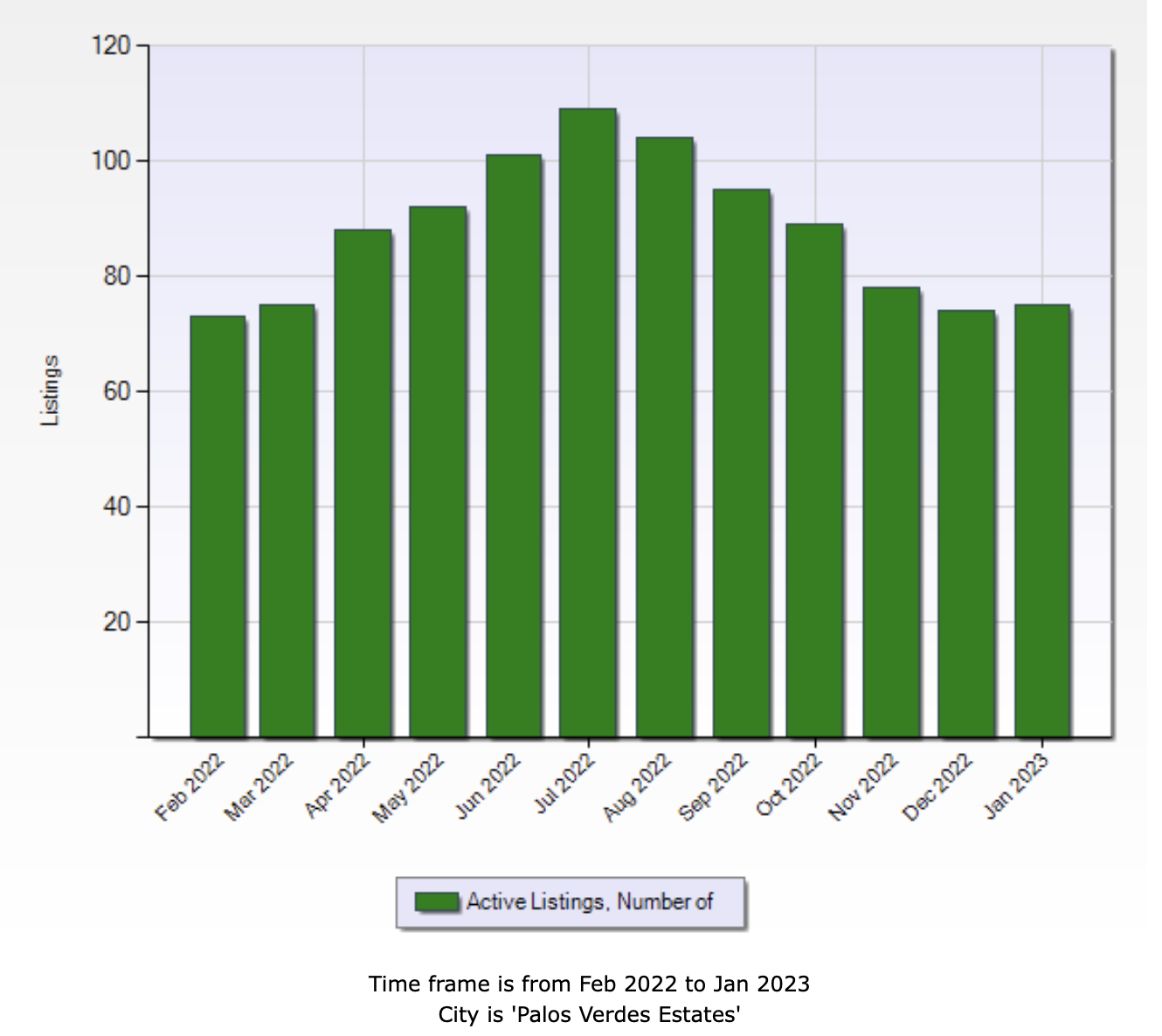

This is not an insignificant number, however, based on what I’m seeing with interest rates stabilizing and the number of active listings decreasing from a peak in July creating a scarcity of inventory (see chart below) I believe we are past the worst of the market correction due to higher rates. In my view, the market has stabilized and will continue to perform in a moderate and “normal” capacity.